Originally from the pit at Tradesports(TM) (RIP 2008) ... on trading, risk, economics, politics, policy, sports, culture, entertainment, and whatever else might increase awareness, interest and liquidity of prediction markets

Wednesday, December 31, 2008

On unions

Any substantial shift of federal and state governments toward pro-union regulations would harm the American economy and the position of the typical employee. As Posner indicates, unions want greater monopoly power so that they can raise the wages and other benefits of union members above their competitive levels. Unfortunately, the effects of this are to reduce earnings for non-union workers, shift production outside the US, or toward states with less pro-union laws, and shift production in unionized plants away from labor and toward capital. None of these changes are beneficial to the efficiency and performance of the American economy, especially in a global environment.--Gary Becker

Quote of the day

The first lesson of economics is that we live in a universe of scarcity, and we face tradeoffs. The first lesson of politics is to ignore the first lesson of economics.--Thomas Sowell

Looking forward to 2009

A Kennedy and Cuomo are competing to succeed a Clinton in New York; the skids are greased for a Biden to replace a Biden in Delaware; one Salazar might replace another in Colorado; and a Governor charged with political corruption in Illinois wants one of his cronies to succeed the President-elect.

Tuesday, December 30, 2008

Senator Dodd may have broken the law

Worse than money laudering for prostitution

While he was New York Attorney General, Spitzer was responsible for policing New York’s estimated 60,000 charities and nonprofits, including his family’s $26 million Spitzer Charitable Trust. Most of those assets were invested in hedge and equity funds whose executives made numerous campaign contributions to Spitzer, according to Matthew Vadum of the Capital Research Center. Spitzer did not recuse himself from investment decisions by the board of his family trust even though a state ethics panel had ruled that top state officials should not serve as directors or board members of regulated agencies.And let us not forget the $42,555 Spitzer received in campaign contributions from lawyers with the now-disgraced Milberg Weiss law firm in his successful 2002 re-election as Attorney General. As first reported by The Examiner in 2007, among those donations were $10,000 from Mel Weiss and $10,000 from former managing partner David Bershad. Weiss is now serving a federal prison term – along with another former senior Milberg Wess partner, William Lerach – after confessing to participating in kickbacks totaling $11.7 million to plaintiffs in more than 150 securities class-action lawsuits brought by the firm in a conspiracy that began in 1981.

During his 2006 gubernatorial campaign, Spitzer said he held himself and his campaign to “a higher standard,” and claimed to have returned more than $124,000 donated by Milberg Weiss lawyers and associates. But when this newspaper asked about the 2002 campaign donations from Milberg Weiss partners, Spitzer’s spokesman refused to say if that dirty money was ever returned.

Who appropriated campaign funds to pay parking tickets

Universal healthcare kills again

Quotes of the day

It is telling that Barney Frank seems to have emerged as one of the leading central controllers somehow qualified to save us all from this mess. That Congressman Frank is enjoying anything other than ignominious ostracization as an utterly failed and deposed elder statesman for his role in destroying the mortgage economy and everything connected to it (i.e. everything) is a testament to the inability of society to select competent leaders. This, in itself, should serve as a cautionary tale to Chicago School detractors. Alas, denial ain’t just a river in Egypt.--EquityPrivate

Do not use [Gaussian distributions] blindly in the real world. It will turn around and bite you. The real world looks far more like hydrodynamics, and wave theory.--Eugene Fama

The Times, whose columnists such as Gretchen Morgenson have been hawks on corporate governance and shareholder value, was curiously mum when it came to the company’s own governance.--Larry Ribstein

... even if you have your doubts about Sarah Palin's experience, it's still fair to say that as a popularly elected governor that Palin was more qualified to be VP than Caroline Kennedy's history as a well-connected poetry anthology editor qualifies her to be Senator from New York. But just as a thought exercise, imagine the reaction if the Washington Post had published a piece on page B1 of the Sunday Outlook section urging people to be "inventive" when examining Palin's qualifications? After all, she has small children so cut her some slack... Yeah, thought so.--Mark Hemingway

Monday, December 29, 2008

David Henderson spanks Tom Friedman

Friedman doesn't seem to understand that to make a case for a tax on the grounds he wants to make it, that is, that it would enhance our prosperity, he needs to make one of two arguments. Either he would need to argue that using gasoline imposes an externality that is so large that the current disproportionately high gasoline tax is too small or that for a given amount of revenue raised, the deadweight loss per dollar raised from an increase in the gasoline tax is less than the deadweight loss per dollar from raising other taxes. Friedman doesn't even try.

Quotes of the day

The very essence of democracy encourages everyone to express opinions about human activities that are none of their business.--Louis Carabini

We should have a recession. People who spend their lives pounding nails in Nevada need something else to do.--John Cochrane

With the Long-Term Capital bailout as a precedent, creditors came to believe that their loans to unsound financial institutions would be made good by the Fed — as long as the collapse of those institutions would threaten the global credit system. Bolstered by this sense of security, bad loans mushroomed.--Tyler Cowen

Thursday, December 25, 2008

Obama whiffs

Thursday, December 18, 2008

Merry Christmas to all

Thanks for reading. It's not easy to believe that I've got the readership that Google Analytics tells me I do.

The Banana Republic of New York

Eight years ago, a Senate seat from the Banana State was won by the wife of a sitting president of the republic. That wife had never before resided in Banana State, but she bought a house there, campaigned with the aura and entourage accorded to a presidential spouse, and with one leap, winning her first elected office ever, she became a senator.

Riding a national political machine to re-election for a second term, that former first lady swiftly turned her Senate seat into a springboard for her own campaign for the presidency. She lost, but took a job in the new administration, leaving the governor of Banana State to appoint a replacement senator.

That governor was himself a replacement, due to the resignation of the elected governor, a crusading moralist caught in a prostitution scandal. As the replacement governor prepared to name a replacement senator, a former president’s daughter declared her interest in the Senate seat — which one of her uncles had won some 44 years earlier, and was using as a springboard for his own presidential run, after serving as attorney-general in his brother’s presidential administration. This former first daughter had recently worked on the campaign of the President-elect — an experience that awakened in her an appetite for politics – but she had reached the age of 51 with no direct experience of her own in public office. Nonetheless, another of her uncles, also a senator, was ready to endorse her for this leap to the Senate. So was the mayor of Big Plum (the biggest city in Banana State), who on his own turf had just succeeded in scrapping a two-term limit so he could run for a third term — which he justified as a way of offering people a broader choice (namely, himself).

That’s how it works in Banana Republics. Whatever Caroline Kennedy’s native abilities, celebrity mantle and political connections, if she thinks this is a good way for things to work in New York State, that alone is reason to worry about her qualifications for the job.

Controversy of the day

I think Ed Glaeser beats Glenn Hubbard

Rationing was a big deal

It will be again, if health care becomes universalized.

Quotes of the day

Instead of shoveling more money and power to the regulators who already had plenty of both, let's take care not to overregulate the people who actually warned about Mr. Madoff's miracle returns. Law enforcement is useful in punishing wrongdoers after the fact, which will deter some crooks. But expecting the SEC to prevent a determined and crafty con man from separating investors from their money is no more sensible than putting your life savings with a Bernard Madoff.--WSJ Editorial Board

The crisis shows that SOX did not have the advertised payoff of flushing Enronesque risk out of the market. Firms now collapsing from risks hidden in their walls and foundations were subject to SOX. What, exactly, did SOX accomplish other than imposing huge costs and giving us a false sense of security for six years?--EAMON JAVERS & LISA LERER

Imagine that Rich Folks Capital Management--RFCM--placed its money with Madoff 10 years ago and then decided, five years ago, that something didn't feel right and pulled it out. Well, now RFCM is on the hook for any of its gains from the time before the fraud was discovered. But what happens if the people who'd invested with RFCM 10 years ago aren't the same as the people who invest with it now? Tough noogies. RFCM's current investors are probably responsible for paying back gains in the RFCM fund that they never even saw. Or, possibly, RFCM needs to go after its own former investors. No one's really sure.--Mark Gimien

One of the largest recipients of Madoff largess was Sen. Charles Schumer (D-N.Y.), who received $39,000 from the family for his two Senate races. Bernard Madoff has given an additional $100,000 to the Democratic Senatorial Campaign Committee since Schumer took its helm in 2005.-- EAMON JAVERS & LISA LERER

Obama has been doing this for awhile: he praised Reagan, recognized legitimate grievances of opponents of affirmative action, affirmed the excesses of New Deal/Great Society liberalism. But while each of those set aflutter the hearts of independents, moderates and the Right, none of them involved actual policy changes. --Jon Henke

Wednesday, December 17, 2008

Katie, you were once my best friend

No woman needs to storm the Bastille of nightly news, because the form has become irrelevant: Oprah has immeasurably more cultural, commercial, and political clout than Charles Gibson and Brian Williams, and no young person is ever going to make appointment TV out of a sober-minded 6:30 wrap-up of stories he or she already read online in the afternoon. Because Katie remembered the old world, the one in which the most-respected news was broadcast at the end of the day, she thought that she was taking a more powerful job. But the Today show—broadcast for four hours a day, a forum for interviews with many of the top newsmakers of the day, as well as for the kind of lifestyle-trend stories it pioneered and that have come to play such a big part in the nightly news—is a far more culturally significant program. One reason that this huge star didn’t have a tell-all biography written about her until now is that while she was at Today, no publisher wanted to antagonize her; a booking on the show was every new author’s dream. The release of Klein’s splashy book, then, is evidence not of Katie’s elevation, but of its opposite. She made the kind of mistake that women a generation younger than hers probably wouldn’t have. She spent her time gunning for a position that had been drained of its status and importance long before she got there. And what she has learned, the hard way, is that her climb to the top has been not a triumph but the act of someone who slept through a revolution.

Like Katie, I have moved on from the Today show. My boys are in school now; I write full-time. I still turn it on for a few minutes each morning, when I’m making coffee or avoiding work. It’s as pleasant as it ever was, but it will never have the urgency it held for me when Katie was there, because I will never again be the mother of small children—abruptly cast adrift from the routines of adult life, cloistered, lonely. I met Katie Couric once, and although she was very nice to me, I was disappointed. We sat on chairs under studio lights and talked, and I hope she didn’t guess what I really wanted to tell her: once, you were my closest friend.

What will the government budget look like

five or ten years from now, when the economy is presumably at some normal level of employment and growth ... as evaluated by the budget deficit and tax revenue as a share of GDP?

Liberals should be outraged

that this person, who is the closest thing to an American hereditary aristrocrat, wants to become a Senator on the quick. It is against everything they are supposed to believe in.Compare Kennedy to Sarah Palin, who was an ordinary person and worked her way up the political system. Even if one believes that John McCain made a mistake by putting her on the ticket too soon, she certainly had an impressive political career before that. But somehow I don't believe that Kennedy will get the Palin treatment.

We need a Czar Czar, to crack the whip on all the czars

Charlie Rangel not paying taxes

For at least five of the last six years, Rep. Charles Rangel (D-N.Y.) and several other members of the Congressional Black Caucus have spent a few days each fall at a different luxurious Caribbean island resort.

The trip’s official mission is to facilitate business and diplomatic relationships between the region and the United States.

This year’s trip took place Nov. 6 to 9, the weekend after the election, on the sun-swept 10-acre Sonesta Maho Beach Resort in St. Martin. The ethics committee approved the Caribbean trip, as it has done for several years, but new information uncovered about its corporate funding raises questions about whether the trip violates a two-year-old ethics rule passed after Democrats regained the House.

Previous Rangel post here.

What might be worse than the Marc Rich Pardon?

Quotes of the day

When your behavior raises my taxes it becomes my business.--Scott Adams

France, long a champion of a heavy government hand in its economy, credits recent deregulation for its ability to grow in the third quarter while other economies shrank.--SEBASTIAN MOFFETT and DAVID GAUTHIER-VILLARS

The S.E.C. must, as they have always been, sort of been the overseer of everything that we do to keep us from injuring ourselves, as well as injuring the public.--Bernie Madoff

Actually, though, Madoff's accomplishment was to instill the same faith in a private sector firm that many people have in government. If his fund were a federal bureaucracy the scheme would have been a snap.--Larry Ribstein

The Wall Street we knew and loved was itself a structured product, one created by Congress 75 years ago, in which the investment banks were private.--Anonymous

But a successful president has to have two qualities. He has to be a good judge of people so that he can get really good people around him. And not be afraid to have really good people around him. Secondly, he has to know when to listen to them, and when not to. And that's judgment. Now, experience helps judgment, but I know a lot of people who are extremely experienced who have terrible judgment.--Brent Scowcroft

... to some extent Washington, D.C. is FDR's grave--or at least his monument.--David Henderson

... we’re only one FEC decision away from having blogging count as contributions-in-kind to election campaigns. Raise a toast to the First Amendment — it was nice knowing you.--Stephen Green

... you probably won’t get very many dates if the first thing out of your mouth is “Will you sign a prenuptial?”--Guy Kawasaki

How about tax breaks for organ donors?

Silver linings

But Wall Street's most famous Ponzi scheme was, like the present one, no small affair. And its principal victim was a man few associate with Wall Street at all -- Ulysses S. Grant.

Ulysses Grant Jr., known as Buck, had been trained in the law and tried several businesses without success before coming to Wall Street. There he was befriended by Ferdinand Ward, a typical all-hat-and-no-cattle fast talker whom Grant was too naive to recognize as such. They soon formed a brokerage firm named Grant and Ward....Ward was soon caught and thrown into the Ludlow Street Jail. He spent 10 years in prison for grand larceny. But there was no saving Grant and Ward, which was found to have assets of $67,174 and liabilities of $16,792,640. By June, Grant had only about $200 in cash to his name. The failure, of course, was front-page news and people began sending him checks spontaneously, which he had no option but to accept. One man added a note to his check, "On account of my share for services ending in April, 1865."

Every cloud, of course, has a silver lining, including the failure of Grant and Ward and the embarrassment of a national hero. Desperate to provide for his family, Grant finally agreed to write his memoirs, something he had stoutly resisted for nearly 20 years, thinking he couldn't write. Mark Twain's publishing firm gave him an advance of $25,000 -- a huge sum for that time. Soon after he began work, Grant learned that he had throat cancer and he hurried to finish the book so as not to leave his family destitute. He died three days after he completed the manuscript.

The book was a titanic success, selling over 300,000 copies and earning Grant's heirs half a million in royalties. But the book was more than just a best seller. It was a masterpiece. With his honesty and simple, forthright style, Grant created the finest work of military history of the 19th century. Even today, most historians and literary critics regard Grant's memoirs as equaled in the genre only by Caesar's "Commentaries."

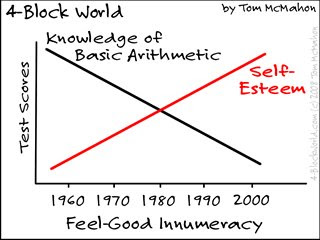

Graph of the day (from the quiz of the day)

This might break the honeymoon between the press and Obama

... I don't want you to waste your question.--President-elect Barack Obama

Tuesday, December 16, 2008

The most famous Ponzi scheme of all

Today's taxpayers contribute money that is funneled to today's Social Security recipients, and hope that tomorrow's taxpayers will put in enough money to fund their retirements. Something similar is true of government finance in general: Those who buy Treasury securities and municipal bonds do so on the assumption that future taxpayers (and bond investors) will keep pouring in enough money to allow governments to make good on their commitments.

UPDATE: Holman Jenkins says:

[Bernie Madoff] may have been casual from the start about what money he used to pay withdrawals. It is almost inconceivable, though, that he could have built a true Ponzi scheme to a height of $50 billion, in which there were never any real assets, just his superhuman 40-year juggling act to ensure new investors were recruited as needed to provide funds to meet withdrawal requests from earlier investors.

If so, he is a genius who should immediately be put in charge of the Social Security and Medicare trust funds.

What not to do

Keynesian "pump-priming" in a recession has often been tried, and as an economic stimulus it is overrated. The money that the government spends has to come from somewhere, which means from the private economy in higher taxes or borrowing. The public works are usually less productive than the foregone private investment.In the Age of Obama, we seem fated to re-explain these eternal lessons. So for today we thought we'd recount the history of the last major country that tried to spend its way to "stimulus" -- Japan during its "lost decade" of the 1990s. In 1992, Japanese Prime Minister Kiichi Miyazawa faced falling property prices and a stock market that had sunk 60% in three years. Mr. Miyazawa's Liberal Democratic Party won re-election promising that Japan would spend its way to becoming a "lifestyle superpower."

...

Japan's economy grew anemically over that decade, but as the nearby chart shows, its national debt exploded. Only in this decade, with a monetary reflation and Prime Minister Junichiro Koizumi's decision to privatize state assets and force banks to acknowledge their bad debts, did the economy recover. Yet recent governments have rolled back Mr. Koizumi's reforms and returned to their spending habits. But Japan does have better roads.

Quotes of the day

The U.S. Securities and Exchange Commission, a once-proud agency with an impressive history as the top cop on Wall Street, finds itself increasingly conducting autopsies of leading financial institutions after failing, in the first instance, to perform adequate biopsies.--Stephen Labaton

Those Washington politicians who repeat the mantra that "bankruptcy is not an option" probably do so because they want to use free taxpayer money to bribe Detroit into manufacturing the green cars favored by Nancy Pelosi and Harry Reid, rather than those cars American consumers want to buy. A Chapter 11 filing would remove these politicians' leverage, thus explaining their desperation to avoid a bankruptcy.--Todd Zywicki

There is something about this epoch in history that really puts a premium on incentives, on decentralization, on allowing small economic energy to bubble up rather than a more topdown, more directed approach, that may have been a more fruitful approach in earlier years.--Larry Summers

I don’t know much about Arne Duncan, President-elect Obama’s choice to be Secretary of Education. But I do note this: In seven years running the Chicago public schools, this longtime friend of Obama was apparently not able to produce a single public school that Obama considered good enough for his own children.--David Boaz

Monday, December 15, 2008

Once upon a time

... there was a blameless girl called Consumerella, who didn’t have enough money to buy all the lovely things she wanted. She went to her Fairy Godmother, who called a man called Rumpelstiltskin who lived on Wall Street and claimed to be able to spin straw into gold. Rumpelstiltskin sent the Fairy Godmother the recipe for this magic spell. It was written in tiny, tiny writing, so she did not read it but hoped the Sorcerers’ Exchange Commission had checked it.The Fairy Godmother carried away armfuls of glistening straw-derivative at a bargain price. Emboldened by the deal, she lent Consumerella – who had a big party to go to – 125 per cent of the money she needed. Consumerella bought a bling-bedizened gown, a palace and a Mercedes – and spent the rest on champagne. The first payment was due at midnight.

At midnight, Consumerella missed the first payment on her loan. (The result of overindulgence, although some blamed the pronouncements of the Toastmaster, a man called Peston.) Consumerella’s credit rating turned into a pumpkin and Rumpelstiltskin’s spell was broken. He and the Fairy Godmother discovered that their vaults were not full of gold, but ordinary straw.

All seemed lost until Santa Claus and his helpers, men with implausible fairy-tale names such as Darling and Bernanke, began handing out presents. It was only in January that Consumerella’s credit card statement arrived and she discovered that Santa Claus had paid for the gifts by taking out a loan in her name. They all lived miserably ever after. The End.

by Tim Harford. Although we should add that Consumerella was pressured by Clinton's Secretary of Housing Andrew Cuomo, and House Jesters (Barney Frank et al) to make loans to people who couldn't pay them back ...

Paradigm shifts in advertising

... So far, no one has found a way to monetize online readers the way that print publications once monetized their distribution.

There are multiple reasons for this. Part of it is the quality of the distribution--papers have a goodish idea of who reads them (and therefore advertisers have a good idea of how many people in their target audience each ad will reach), while God knows who's clicking on your web page. There's also the fact that a lot of advertising is brand enhancement, and that doesn't work very well on the web. Those tiny spaces alongside web pages are good for advertising specific goods, but not so good at putting an elegant gloss on the image of Singapore Airlines, which is why Google is so far the biggest winner in web ads.

Then there are the readers. People either like, or don't care about, print ads. On the other hand, they hate web ads. The more an ad intrudes on their consciousness, the more they hate it, which is something of a conundrum for the brand builders. And no one's yet found an effective service to strip all the ads out of a print publication.

Still, part of it is just irrational. In a lot of ways, web advertising is superior: much easier to track both views and response. But so far, advertisers will only buy it at a steep discount. Unless that changes, the future of the American newspaper is grim indeed.

That said, it takes a while to figure out how to make advertising work in a new medium. The original television ads were simply transplanted radio ads, and they were dreadful--just as the original radio ads consisted of someone reading a print ad, which didn't work very well. We may just be waiting for our advertising revolutionary who can show us how to make webvertising work.

Walmart gives away $301 million to charities, and $400 million to customers this month

Why profit is better than government

... the English dictionary was composed by a single man in seven years; whereas the French dictionary was composed by a body of 40 members in an agonizingly slow 55 years. This fact seems bizarre at first; many people, by dividing the work amongst themselves, surely should have been able to complete roughly the same task that one man was engaged in in less time than it took that one man.

Yes, Samuel Johnson was a genius, but the French Academy also had its share of geniuses; even if we were to make the wild assumption that Samuel Johnson had the mental powers of ten Academicians, Johnson would still have been outnumbered by four to one; so surely genius alone cannot explain the vast anomaly. I suggest that much of the contrast can be explained by the ineluctable differences inherent in a collective, government-sponsored effort and in one that is individual and profit-making.

Cartoon of the day

Scott Adams says:

Think of financial theory as a stool. The stool is supported by three legs, or truisms.and

- History always repeats.

- Past performance is no indication of future returns.

- Asshats are trying to steal your money.

People who say it is a good time to invest are called bulls. The bulls are at the center of all financial problems.

In summary, if you want to understand financial markets find a bull and look at his stool.

Where's the outrage?

Interestingly, what most people have objected to is its starkness rather than its essence. Blagojevich's behavior can be divided up into three elements:

1. The exchange of political favors for personal payoffs.

2. The explicit discussion of #1.

3. His foul language.While many people seem to object to all three, many of these same people really object only to #2 and #3. In other words, they don't really object to #1.

Why do I say that? Consider a case of #1 that received little objection. In 2005, shortly after her husband became a U.S. Senator, Michelle Obama was promoted to vice-president of the University of Chicago Hospitals, with a salary increase from $121,910 to $316,962. One of her bosses said she was "worth her weight in gold." In 2006, Obama requested a $1 million earmark for his wife's employer. How upset have people got about this? But take away the explicit exchange and the crass language and she and her husband did what he Illinois Governor did.

Quotes of the day

... I came to realize that the object of life is not prosperity, as we are made to believe, but the maturing of the human soul.--Alexander Solzhenitsyn

If Blagojevich is guilty, the best thing that could happen to him is to be tried and convicted. He's going to have to reach rock bottom -- just as I did -- before he will be able to escape his own prison of pride, self-delusion and self-righteousness. But that's a transformation we can never accomplish on our own. I can vouch for the fact that human pride is simply too strong.--Chuck Colson

Running a billion dollar Ponzi scheme has to be very time consuming. Running a $50 billion Ponzi scheme by yourself, at age 70? ... I don’t think it can be done.--Barry Ritholtz

... government actions and interventions caused, prolonged, and worsened the financial crisis.--John Taylor

After all, the UAW was perfectly willing to negotiate their compensation package--in 2011, when their current contract expires. ... And I think that's perfectly reasonable. We'll just wait until 2011 to give them the money, then.--Megan McArdle

With great foresight, I long ago entered the mattress business in a big way through our furniture operation. Now mattresses have become fully competitive as a place to put your money, and sales will soon take off.--Warren Buffett, on 0% yielding treasuries

Why do governments so often let inflation get out of control? Because they can profit from it. Seignorage is the process in which governments implicitly tax their citizens by printing money.--Charles Wheelan

I prayed to the Lord this morning to please keep me humble, and not say too many negative things about Oakland.--LaMont Jordan, on playing his former team

Bleed The World

And there won't be city bonuses this Christmastime

The only thing they'll get this year is fired

No strippers or cocaine

Just anger, hate and blame

...

Here's to you

They're all unemployed

Here's to them

The economy's destroyed

Why didn't you speak up sooner, Governor?

But [Governor David Paterson] called the SNL spoof a "third-grade depiction of people and the way they look" that could lead others to believe that "disability goes hand-in-hand with an inability to run a government or business."Hmmm, I seem to recall that being from mom from Alaska who was previous a small-town mayor also went hand-in-hand with an inability to run a government ... and SNL was getting some awesome ratings at that time.

Regulation does not work

Appointing a Regulation Czar or approving New Legislation is not going to work, folks. Government regulators will continue to miss by a mile sometimes.

Unless they are set up with the right incentives, insulated away from conflicts with the parties which they must oversee.

UPDATE: Larry Ribstein identifies two dangers with regulation:

1) First, it can make investors over-confident or over-trusting.

2) The second danger comes from fixing the first. A determined regulation advocate will insist that at some level we can really make investors safe. But even if that's true, the necessary regulation would seriously constrain the kind of risky activity that is necessary to grow the economy. We'd have to distrust all innovation, particularly financial innovation, and turn business people into bureaucrats. Just what we don't need right now.

Friday, December 12, 2008

I've been posting cynical, so I'll end on a higher note

If you can get away with a mortgage kickback

It's nice that President Bush and Cerberus head John Snow

The Bush administration is signaling its readiness to avert a collapse of the nation's auto industry, a day after efforts to forge an emergency-relief package foundered in the U.S. Senate.I'm not sure who will be remembered to be a morally worse President, Bill Clinton or George W. Bush. I'm thinking the latter. Of course, only 4 Presidents have been re-elected in my lifetime, so by that measure, Jimmy Carter and George H.W. Bush are a cushion for the others.White House spokeswoman Dana Perino said the administration would consider tapping the $700 billion government pool -- known as the Troubled Asset Relief Plan, or TARP -- that was created ahead of the November election to calm turmoil in financial markets.

Merry Christmas, Congressional GOP

Obama campaign and Blagojevich conference on Nov 10

Quotes of the day

Only two things are infinite, the universe and human stupidity, and I'm not sure about the former.—-Albert Einstein

Mr. Waxman calls it a "myth" that Fannie and Freddie were the originators of the crisis. That's a red herring. Mr. Waxman's documents prove beyond doubt that Fan and Fred turbocharged the housing mania with a taxpayer-backed, Congressionally protected business model that has cost America dearly.--WSJ Editorial Board

On Election Day, I knew more about Sarah Palin's relationship with Wasilla's librarian than Senator Obama's relationship with Governor Blagojevich, whose campaign he helped run in 2002. ... Why is that? Is it because, as the media explained at the time, Obama had already been vetted and Palin hadn't?--John Ennis

And I would have stayed up with you all night

It was easy to get lost in the sweet dreams concocted by Big Three management, the UAW and Washington politicians that $14 billion and a “car czar” would make everything all right.

But c’mon, nobody actually believed that. You may be angry at Tennessee Senator Bob Corker for the wake-up call. But you should actually thank him. He may have just saved your life.

Hell freezes over

Some will talk of the pension funds and others that will suffer. Yes, but that is true of every investment that has diminished. The government may need to help some pension funds but it is better to do so directly, than via massive bail-outs hoping that a little of the money trickles down to the “widows and orphans”. Some will say that bankruptcy will undermine confidence in America’s cars. It is the cars and carmakers themselves – and the dismal performance of their executives – that have undermined confidence. With industry experts saying $125bn (€94bn, £84bn) or more will be needed, with bail-out fatigue setting in, why should US consumers believe that a $15bn gift will do the trick of a turnround?

It is more plausible that confidence will be restored if the industry is freed of the burden of interest payments and is given a fresh start. Modern cars are complex technological products and the US has demonstrated its strength in advanced technology. US workers, working for Japanese carmakers, have shown their hard work can produce cars that are desirable. America’s managers too have demonstrated their managerial skills in many other areas.

Madoff Securities = Ponzi Scheme. Where were the regulators?

It is easy to say and hear "we need more regulation". It doesn't mean it works. (Except for the people who get paid from it--including special interests and their favorite election campaigns).An executive in the securities industry, Harry Markopolos, contacted the SEC's Boston office in May 1999, urging regulators to investigate Mr. Madoff. Mr. Markopolos continued to pursue his accusations over the past nine years, he said in an interview on Thursday, and according to documents he sent to the SEC that were reviewed by The Wall Street Journal.

"Bernie Madoff's returns aren't real and if they are real, then they would almost certainly have been generated by front-running customer order flow from the broker-dealer arm of Madoff Investment Securities LLC," Mr. Markopolos wrote to the SEC in November 2005.

The SEC declined to comment on the matter.

If investors cannot get better auditing--as the auditors are paid by the managers--then perhaps we do need a government program to audit financial services. With my libertarian sentiments, government is usually my last resort. But for liberties, rights, justice, infrastructure, land deals (e.g. Louisiana and Alaska purchases), and neglected basic research (internet), government has proven to be more successful than the private sectors.

UPDATE: Felix reports that the Madoff auditor certainly looks fly-by-night.

Thursday, December 11, 2008

Self-made billionaires, and their first jobs

Like Michael Dell, I was a dishwasher for most of my high school time, although I did some landscaping and babysitting for about $2/hr, before the massive 50% increase when I started at the restaurant.Warren Buffet

Greatest Wealth - $62 Billion at age 77

First Job – Newspaper delivery boyMichael Dell

Greatest Wealth - $17.3 Billion at age 43

First Job – Dishwasher for a Chinese restaurantSteve Jobs

Greatest Wealth - $5.4 Billion at age 53

First Job – Gopher at Hewlett PackardOprah Winfrey

Greatest Wealth - $2.7 Billion at age 54

First Job – Part time radio news broadcasterMark Cuban

Greatest Wealth - $2.8 Billion at age 50 (and probably half of that after his divorce)

First Job – Bartender

Still have yet to crack a billion.

Intrade lists new Chrysler, Ford and GM contracts

Intrade has now listed a series of new markets concerning the "Big 3" US Automakers of Ford, General Motors and Chrysler. These markets can be found under Business - Automakers.

The markets listed are:

Resignation of General Motors CEO Rick Wagoner

Ford, GM and Chrysler to file for Chapter 11 Bankruptcy

US Government bailout of US Automakers in 2009

Announcement here.

Quotes of the day

Bankruptcy doesn't make assets -- such as factories, machines, contractual options to buy raw materials, workers' skills -- disappear. If markets still exist for products produced by these firms, Chapter 11 is the best way to discover this.--Don Boudreaux

I think that the CEO's at Freddie and Fannie were in a better position than anyone else to stop the madness. But if your idea of a housing system is to build up two firms with enormous power and count on them to exercise that power judiciously, then you might want to rethink your model.--Arnold Kling

... the [payroll] tax cut stimulates demand not only by increasing disposable income and consumption spending (the textbook Keynesian channel) but also by incentivizing more investment spending. A similar result might obtain if the tax cut included, say, an investment tax credit. ... My advice to Team Obama: Do not be intellectually bound by the textbook Keynesian model. Be prepared to recognize that the world is vastly more complicated than the one we describe in ec 10. In particular, empirical studies that do not impose the restrictions of Keynesian theory suggest that you might get more bang for the buck with tax cuts than spending hikes.--Greg Mankiw

New Yorkers are Democrats, and even the terrors of the 70s and the revival of the 90s weren't enough to change that.--Bryan Caplan

Wednesday, December 10, 2008

Nancy Pelosi might "drain the swamp"

Barack Obama met Rod Blagojevich as recently as November 5

The main problem with academia

UPDATE: Peter Wehner has the latest international standings for 4th- and 8th-graders. Things are mixed.

A Senate seat is worth about $6 million

I think he should include some sort of opportunity cost--the average person earns $40,00 per year or so. Still, that is a lot of dough for someone's who might be proven to be a vote-getter, but little else.

Scientific dissent over global warming

Jesse Jackson Jr. offers up $1 million for vacated Illinois senate seat

Rep. Jesse Jackson Jr., D-Ill., is the anonymous "Senate Candidate No. 5" whose emissaries Illinois Gov. Rod Blagojevich reportedly offered up to $1 million to name him to the U.S. Senate, federal law enforcement sources tell ABC News.According to the FBI affidavit in the case, Blagojevich "stated he might be able to cut a deal with Senate Candidate 5 that provided ROD BLAGOJEVICH" with something "tangible up front."

Jackson said this morning he was contacted Tuesday by federal prosecutors in Obama whom he said "asked me to come in and share with them my insights and thoughts about the selection process."

Jackson said, "I don't know" when asked whether he was Candidate No. 5, but said he was told "I am not a target of this investigation."

Jackson said he agreed to talk with federal investigators "as quickly as possible" after he consulted with a lawyer.

Felix, meet Arnold

Arnold seems to one-up, though:

Salmon says that credit default swaps have "other uses" than price discovery. Those other uses seem to me to consist primarily of creating systemic risk and huge swings in liquidity preference in response to revaluation of out-of-the-money put options.

The Chutzpah Award goes to Franklin Raines

who complained that regulators did not do enough to stop Freddie and Fannie from buying high-risk mortgages. I don't know where to begin on that one. I would say it's like a teenager who insists that you let him go to a party, then after he gets drunk and gets put in jail complains that you needed to give him more supervision. But it's even worse than that, considering all the lobbying Fannie did under Raines with the main purpose of emasculating regulation.UPDATE: John Lovelace submits a worthy alternative:

Is this what you call chutzpah? Sen. Chris Dodd of Connecticut has demanded that the chief executive officer of General Motors resign because of the management of GM during his tenure.

Isn’t this the same Sen. Dodd who along with his House counterpart Rep. Barney Frank continued over the years to tell the public that Fannie Mae and Freddie Mac were fine upstanding organizations with no financial problems while they were in fact in the process of collapsing?

Additionally, wasn’t Sen. Dodd the one who took sweetheart loan deals from Countrywide Financial?

When you're behind on your bills

American International Group Inc. owes Wall Street's biggest firms about $10 billion for speculative trades that have soured, according to people familiar with the matter, underscoring the challenges the insurer faces as it seeks to recover under a U.S. government rescue plan.

The details of the trades go beyond what AIG has explained to investors about the nature of its risk-taking operations, which led to the firm's near-collapse in September. In the past, AIG has said that its trades involved helping financial institutions and counterparties insure their securities holdings. The speculative trades, engineered by the insurer's financial-products unit, represent the first sign that AIG may have been gambling with its own capital.

Quotes of the day

And you thought infrastructure investment meant roads, bridges and schools. It is clear that any infrastructure stimulus money given to the country's mayors will lead to thousands of tennis centers to nowhere. News alert for mayors: We are officially in a recession. American families have to get by with less, and so do American cities.--Robert Poole

There's no market price for cancer.--Richard Lefrak

An economist might suggest letting a few producers fail, so supply shrinks, prices rises, and the remaining producers become more profitable.--Greg Mankiw

A stock may look tantalizingly cheap, but sometimes that's for good reason.--Tom Lauricella

Loan modifications undermine the honesty of the market. They delay the necessary adjustments. With foreclosures, it might take two years for the housing market to find a bottom. With loan mods, it will take at least ten years.--Arnold Kling

I can imagine a consensus emerging to take Freddie Mac and Fannie Mae back under the government and use them to try to modify troubled loans. That would be the worst possible outcome. I spoke out against loan modifications, but I'm sure that I am a voice in the wilderness. The more we try to do loan mods, the longer the crisis will last and the more it will cost taxpayers. Other than that, they are a wonderful idea.--Arnold Kling

... think for a minute about the car czar's responsibility for Opel, and the negotiations which are going to start up between the US and German governments over the European marque's fate. On the one hand, Opels are clearly the kind of thing which Congress wants GM to make more of. But they want GM to make those cars in America, not in Europe. And GM has already asked the German government for money to keep Opel going.--Felix Salmon

There's something really sad about having gone so far that your indelicacy actually amazes the folks who want to legalize prostitution and open air drug markets.--Megan McArdle

Palin’s Alaskan career is roughly six times more impressive than Kennedy’s years as a high-minded Manhattan socialite and custodian of her family’s good name. That doesn’t mean that McCain was wise to pick Palin as his running mate. But if you think he wasn’t, then you should definitely hope that the Democratic Party of New York hunts a little longer through its ranks before handing a Senate seat to the editor of The Best-Loved Poems of Jacqueline Kennedy Onassis.--Ross Douthat

As an Obama supporter and contributor, I've been very gratified by his dignified deportment and steadiness at the helm to date. But I must admit to puzzled disappointment with his recycling of Clinton era veterans, who reek of déjà vu.--Camille Paglia

How can it be that so many highly educated Americans have so little historical and cultural consciousness that they identify their own native patois as an eternal mark of intelligence, talent and political aptitude?--Camille Paglia

Bankruptcy, then bailout

Shouldn't they cast off all their baggage before attempting to finish the race?

UPDATE: Holman Jenkins on the bailout:

Alas, Barack Obama's vaunted "change" apparently doesn't include spending the political capital to make Congress acknowledge the failure of CAFE. If he can't do better than throw taxpayer money at a dismal policy disaster like our fuel-economy regulations (and so far he seems to be joining Congress in pretending it's all Detroit's fault), we might as well give up on his presidency along with any hope of progress on the nation's other unresolved dilemmas.

His campaign never really answered the question of whether he was Chance the Gardener or Abraham Lincoln. We might as well find out now.

Tuesday, December 09, 2008

Scientists do not believe constitutional rights are potentially benefical

I'm not a big Second Amendment advocate, but I am uncertain where our rights come from if not from the Constitution. And discriminating against people with disabilities seems, um, unconstitutional as well. Two wrongs make an exponential wrong.

And, no, I do not believe that any type of arm should be legally borne by citizens. Just whatever arms criminals have been found to bear. Oh, and in the spirit of the American Revolution, soldiers too, I guess.

And we could undo the Second Amendment--there are constitutional procedures for that. But the Second Amendment is basically a check against state power, which helps keep the government "for the people". So it would be nice to come up with some offset to take the place of the Second Amendment.

What is the IQ of Congress?

It's Not A Wonderful Life

One prediction markets trader weighs in on the future of Intrade

I'm not withdrawing any of my Intrade funds (and will only do so after I recoup some of those long Giuliani losses).It is clear that they took some serious damage with their margin system and could not adequately protect their users’ funds - they announced that effective today that margin could no longer be used by members. (FYI, I never used margin). What happened is that there were some contracts that people leveraged up, and could not de-leverage without affecting the market price and were left with accounts with heavy negative balances, and corresponding positive balances on the other side. Since they had to pay off the people with the positive balances, they had to collect from the negative balances - something they obviously can’t do. They possibly took losses during the last presidential election (what would otherwise be a money-maker).

There are a few other red flags concerning Intrade, one being putting up a credit market on their own future viability - they actually have a market whether the business will still be in operation by a certain date! This is like buying insurance from a company with a policy on whether the insurance company will still be in business or not - if you “win” and the insurance company goes bankrupt, you still lose by not getting paid.

Intrade has had a history of showing very bad judgement on judging certain contracts. The North Korea Missile contract was a well-known debacle (one that I made money on because I knew they were stubborn enough to rule a certain way about it), and my ability to trust them on judging certain other markets correctly was highly suspect, so I only stuck to as-unambiguous-as-possible contracts.

One other issue with Intrade dealt with how its commission structure actually was used to take money from its customers through commission differentials - basically multi-candidate contracts (with a single winner) would have combined bid prices greater than 100% because of how the commission structure worked. Essentially the exchange would be able to arbitrage by selling contracts of everybody commission-free and make some money this way off the back of the people providing liquidity on the site. While this is not illegal or the moral equivalent of stealing, it is something that was rather disturbing about their model.

The other red flag dealt with the actual CEO of Intrade, John Delaney. He sent me an email on April 2007 out of the blue saying he would be in Vancouver and wanted to know if we could meet up. Apparently he had read somewhere that I made this presentation on prediction markets (he probably didn’t read further and realize it was at Barcamp, which is not exactly the most academically accredited event, although make no mistake - it was well worth going to). I said yes to the meetup, and we eventually met up for lunch at some Japanese restaurant in downtown Vancouver.

The conversation was fairly strange. It began with 10 minutes of small talk, about how he likes visiting the more “dodgy” areas of places, but after that he drilled me for contacts regarding software development and web-based user interfaces which caught me off guard.

Seniors eating their grandchildren

Anecdotally, earlier this year my dad said he did not care what problems or debts his grandchildren inherited from his generation, as long as 'he got his'. My wife has still not gotten over it.

And yes, his beautiful grandchildren were sitting around the table with us when he said it.

Relatedly, this makes me George Constanza. Even the shrinkage episode, unfortunately, applies. Ocean waters in the Northeast are not as vibrant as those off the Hawaiian Islands. Good thing I arranged for my honeymoon there.

Mortgage modifications are not working

We shouldn't tax responsible people to bailout irresponsible people (only responsible people).

Policies will suffer from rounding error and creep, but let's not make erroneous and creepy policy.

More evidence that business cycles are not all alike

Notice how strikingly different the two recessions are. The last recession shows up strongly in nonresidential investment, while residential investment hardly notices the downturn. This time, residential investment takes a big plunge, while nonresidential investment has not been much affected (yet).

Right-size the financial sector while slowing down the pace of de-leveraging

In my opinion, the bailouts and rescues are not helping with either process.More Arnold here:

Unfortunately, stuff happens. The bank may suffer a solvency shock, because of a really bad disease outbreak. Or, the bank may suffer a liquidity shock, because of an unusually high rate of withdrawals. It is easy imagine a slight solvency shock leading to a liquidity shock, because depositors may believe that the last one to withdraw will find that the bank is out of money.

If stuff happens, then the financial sector (the bank) will contract suddenly and sharply.

Don't just throw out the current auto executives

The nation would be better off today had Lee Iacocca gone into telecommunications or media after getting dumped by Ford. Chrysler should have been left to die, and there would have been much less wealth destroyed in the last 3 decades.

And there would be one less corrupt voice crying out for universal healthcare. And one less idiotic voice crying for plug-in electric cars, which will actually increase carbon emissions as most electricity is coal-fired.

Speechless

Government is not always the solution

The extent of the problem is likely to come to the fore on Tuesday, when a former Fannie Mae executive and several outside experts are scheduled to testify before the House oversight committee about the company’s condition.

Of particular concern is how Fannie Mae accounts for subprime mortgages and so-called Alt-A home loans, which are technically a rung above subprime. Some critics say that Fannie Mae defines these loans loosely, which could expose the company to new, gaping losses.

Among those scheduled to testify on Tuesday are Edward J. Pinto, a former credit officer at Fannie Mae, and Charles W. Calomiris, a finance professor at Columbia who has studied the government-sponsored enterprises, or G.S.E.’s. “Fannie has a vast universe of junk loans,” Mr. Pinto said.

Peter J. Wallison, a fellow at the American Enterprise Institute and a longtime critic of Fannie Mae and Freddie Mac who issued a critical report of Fannie Mae with Mr. Calomiris in September, said Fannie Mae’s vague definitions for risky mortgages had masked its potential losses.

“Fannie is a much bigger and deeper hole than anybody has yet realized,” Mr. Wallison, a former Treasury Department counsel, said.

Fannie Mae lost $29 billion in the third quarter. Most of that deficit — more than $21 billion — reflected write-downs of deferred tax assets, rather than ailing mortgages. Fannie said last month that it was bracing for additional losses and might need more than the $100 billion that the government had pledged.

But in an interview, Mr. Wallison said that Fannie Mae’s losses could rise at least $100 billion because of “junk loans” that are obscured on its books.

Subprime loans, which are often defined as loans made to borrowers with FICO credit scores below 660, accounted for $8.7 billion, or about 0.3 percent, of Fannie Mae’s total holdings of single-family mortgages, according to its third-quarter financial statement. But Fannie uses its own definition for subprime loans and does not disclose some of these definitions.

De-perversing incentives

Under the plan, Morgan Stanley will withhold a portion of its employees’ bonuses for three years. If a worker’s bets on the markets go wrong during that time, some of the bonus will not be paid. The so-called claw-back provision is intended to discourage employees from making short-sighted decisions by tying their compensation to the bank’s long-term performance.Seems like a good idea. However, it may disincent top talent from going to MS, or staying, if they can get paid better elsewhere.

Quotes of the day

That money talks I’ll not deny, I heard it once, It said ‘Goodbye’.--Richard Armour

The Federal Reserve would be extremely reluctant to extend credit where Congress has actively considered providing assistance but, after due consideration, has decided not to act.--Ben Bernanke

GM's crippling financial burden and huge competitive disadvantage comes from its significant legacy costs: 4.61 retired members and surviving spouses (receiving pensions and health benefits) per active worker.--Mark Perry

It is not only consumers that must delever. Governments must as well. State and local governments across the nation have incurred direct and indirect debt or obligations in the tens of trillions of dollars -- obligations that cannot be met under any set of reasonable circumstances without an explosion in growth and tax revenues. In fact, we continue to incur debt for politically palatable ideas, like rebate checks, which have very little stimulative power but increase the depth of the hole we're in.--Harvey Golub

The foundation has an astounding $13 billion in assets. So one might ask: Why doesn't the Ford Foundation liquidate and transfer the money to the Ford Motor Co.?--WSJ Editorial Board

Ironically, while the various public broadcasting stations try to come across as open-minded people who want the truth to come out, by trumpeting this movie and not mentioning one important thing left out, they are not trying to broadcast the whole truth at all.--David Henderson

Mr. Obama's emphasis on weatherization and alternative lighting reminds me of President Carter's admonition to turn down the thermostat and wear cardigan sweaters. Maybe it works as a short-term sound bite, but it is not much of a long-term policy.--Greg Mankiw

Politicians don't listen because progressive and libertarian activists are not pushing minor schemes to benefit themselves greatly at small cost to everyone else. They are pushing for radical change that will require radical fiscal medicine to effect. That fiscal medicine will not pass unnoticed, and hence, it does not happen. ... This does not make me happy. It does not make me happy that I can't privatize social security and eliminate the corporate income tax, and it does not make me happy that I can't have radical agricultural reform and a stiff carbon tax. But the universe is not here to please me.--Megan McArdle

Spread a rumor that a Koran got flushed down the can at Gitmo, and there’ll be rioting throughout the Muslim world. Publish some dull cartoons in a minor Danish newspaper, and there’ll be protests around the planet. But slaughter the young pregnant wife of a rabbi in Bombay in the name of Allah, and that’s just business as usual. And, if it is somehow “understandable” that for the first time in history it’s no longer safe for a Jew to live in India, then we are greasing the skids for a very slippery slope.--Mark Steyn

So we have two studies drawing two conclusions. The first finds that happiness is contagious; the second finds that researchers can too easily draw false conclusions about contagion. Guess which one grabbed the attention of headline writers.--Justin Wolfers

... I'm still disappointed that a receiver didn't honor Plaxico Burress last weekend by catching a touchdown, then pretending to shoot himself in the leg with the football and limping around.--Bill Simmons

Monday, December 08, 2008

David Henderson busts deregulation mythology

Many journalists claim that the U.S. economy since the late 1970s has been very free, with little regulation; that this absence of regulation has caused markets to fail; that there was a consensus in favor of little regulation; and that, now, this consensus is fading. On all these counts, the reports are false.

...

Free markets have done much better than governments at providing safety, fairness, economic security, and environmental sustainability. The reason, for three out of the four, is simple. Economic freedom tends to lead to economic growth, as Pearlstein himself admits in the above quote, and economic growth leads to more safety, more economic security, and more demand for environmental quality. Safety and environmental quality are what economists call "normal goods." As our real incomes rise, we want more of them. Over the 20th century, as our real incomes rose, we workers demanded more safety. And we got it. As economist W. Kip Viscusi notes in "Job Safety," published in The Concise Encyclopedia of Economics, as U.S. per capita disposable income per year rose from $1,085 in 1933 to $3,376 in 1970 (all in 1970 prices), death rates on the job fell from 37 per 100,000 workers to 18 per 100,000. Note that all of this preceded the Occupational Safety and Health Administration, which began in 1970. This shouldn't be surprising. As workers, we show our demand for safety by the wage premium we insist on to take a given risk. As real incomes rose, this wage premium rose. Employers found it cheaper to avoid some of the risk premium by reducing risk—that is, by increasing safety. In short, there is and has been a "market for safety."The case with environmental quality is similar. Past some income level, environmental quality is almost certainly a normal good, that is, a good that people demand more of as their income increases. But demand does not guarantee supply. Why not? One major factor is that so much of the environment is a "commons," a resource that everyone can use but no one owns. As Garrett Hardin pointed out in his classic 1968 article "The Tragedy of the Commons," when no one owns a resource, it will be overused because no one has much incentive not to overuse it. One obvious solution is to transform, to the extent possible, the commons into private property. This has been done with rivers, lakes, and land, but is hard to do with air and oceans. But certainly we could go much further toward private ownership than we have until now, turning rivers, for example, into private property, as is done in Scotland. Scotland, not coincidentally, has pristine rivers. So note the irony. Contra Pearlstein, one reason that we haven't had the environmental quality we have demanded is that overregulation has prevented private ownership.

On the issue of economic security, the wealthier we are, the more secure we are. And because, as Pearlstein himself admits, economic freedom creates wealth, it necessarily creates security.

...On housing prices, Gosselin claims that "the rise in house prices and the recent plunge grew out of an almost unregulated corner of the mortgage market—the one for riskier loans." But in fact much of this problem arose from regulation. Jeffrey Hummel and I detailed how in Investors' Business Daily ("Blame the Feds, Not the Fed, For Subprime Mortgages," March 23, 2008). Federal government regulation contributed in three ways. First, the federal government helped cause the boom in housing prices by helping cause moral hazard: people taking risks because they know that if things turn out badly, someone else will bear some of the cost. The federal government's semiautonomous mortgage agencies—Fannie Mae, Freddie Mac, and Ginnie Mae—all buy and resell mortgages. Of the more than $15 trillion in mortgages in existence in early 2008, about one third were owned by, or were securitized by, Fannie Mae, Freddie Mac, Ginnie Mae, the Federal Housing and Veterans Administration and other government agencies that subsidize mortgages.

Although Fannie Mae and Freddie Mac were no longer government agencies during the time period at issue, they were government- sponsored enterprises. Many buyers of their repackaged loans, therefore, assumed an implicit federal-government guarantee. That assumption, as we now know, was all too true. This implicit guarantee caused less scrutiny by lenders than otherwise, which helped drive up housing prices.

The federal government's second contribution to the increase in housing prices was the Community Reinvestment Act. This act, first passed in 1977 and beefed up in 1995, requires banks to lend in high-risk areas that they otherwise would avoid. Banks that fail to comply pay fines and have more difficulty getting approval for mergers and branch expansions. As Stan Liebowitz, a University of Texas economist, has pointed out, a Fannie Mae Foundation report enthusiastically singled out one mortgage lender that followed "the most flexible underwriting criteria permitted." That lender's loans to low-income people had grown to $600 billion by 2003. Its name? Countrywide, the largest U.S. mortgage lender and one of the lenders in the most trouble for its lax lending practices.

Finally, a little-noted change in regulations by the comptroller of the currency in December 2005 acted as the trigger. The comptroller made it mandatory for banks to require minimum payments on credit card balances, causing increases of at least 50 percent for most cards and as much as 100 percent on others. Many people who hold subprime mortgages are people for whom a higher monthly payment on a credit card would be a problem. Whereas before this regulation, many people's priorities would have been mortgage first, credit card second, the new regulation caused many borrowers to reverse the order. Thus the comptroller's seemingly small increase in regulation had the unintended effect of causing some mortgage borrowers to default.

...Moreover, notably absent from all four earlier-mentioned articles is an argument for why regulation would work or how deregulation fails. I have already provided evidence of how badly regulation has worked in oil and in the housing market. But there's more to say. There are two main reasons that regulation generally works out badly. One is that the regulators have little incentive to get things right. Indeed, when their regulations fail, they often use this fact to argue for more power and more regulation. Astonishingly, the argument often works. The second reason is that regulatory agencies are often captured by the politically powerful and used to stomp out competition. The recent regulations on housing finance, for example, require mortgage brokers to be licensed. That will reduce competition in mortgage brokering and enhance the incomes of existing mortgage brokers.

...But shouldn't economic journalists, whatever else they do, get the facts right? And the three overriding facts are:

(1) we have not had a period of light regulation,

(2) deregulation didn't fail, and

(3) regulation makes things worse.

Quote of the day

Protected Your Right to Arm Bears--Bill Fleckenstein's sign

Rap of the day

Umemployment at a record highMy colleague and I were doing this one before 8am. (Yes, we are that old).

People come, people go, people born to die

Don't ask me, because I don't know why

But it's like that--what?

And that's the way it is--Afrika Bambaataa and the Soulsonic Force

Evokes this.

It's not just women's studies programs

Friday, December 05, 2008

How to cut needless medical expenditures

BCWUW4: British Healthcare Horrors

The New York Times has a front page story today on the British system of rationing. It’s a long read, but an important one. And right up towards the top, you see why. The British system has made a choice. They have valued six months of life at $22,750. That’s all they can afford, they say. So here’s the question: In a government system in the US, should the government be on the hook for more than that? If six more months of life—not a cure, but a six month reprieve-- would cost $50,000, should we pay for that, keeping in mind that that money is coming from priorities like education and food stamps and wages increases? Or should we have limits? Should the system itself ration?The real question, however, is who decides? Do you really want some government official deciding whether you get $23,751 worth of care?

What I find particularly objectionable about the British rationing system is the effort they make to prevent private funding. If I can afford to spend $100,000 to buy a six month reprieve, why should the government tell me not to do so? Yet, in the UK, opting for private funding of a single treatment apparently can result in your exclusion from the rationed care system in its entirety.

Liberty not egalitarianism is the basic principle on which the USA was founded. As Andrew Sullivan comments:

One reason I’m a conservative is the British National Health Service. Until you have lived under socialism, it sounds like a great idea. It isn’t misery - although watching my parents go through the system lately has been nerve-wracking - but there is a basic assumption. The government collective decides everything. You, the individual patient, and you, the individual doctor, are the least of their concerns. I prefer freedom and the market to rationalism and the collective. That’s why I live here.

Be Careful What You Wish For.

Excess and Drawdown for Wall Street Elites

Well, not in my condo building downtown. I never got paid what these guys did. I can't even fathom taking a mortgage out beyond the interest writedown limit. What person of mathematical ability does that?